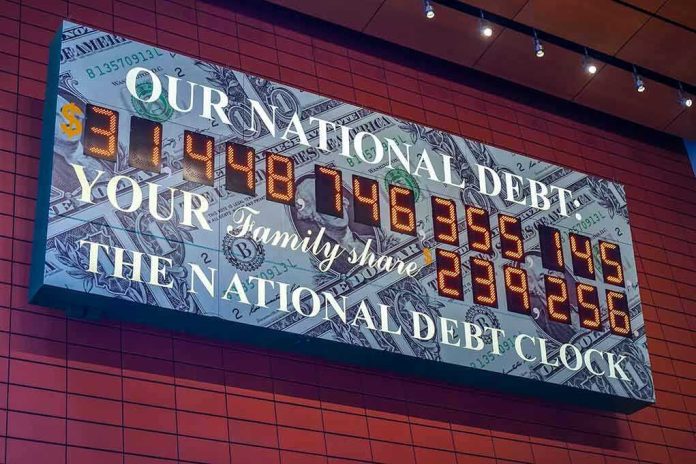

America’s federal deficit soared to $144.75 billion in December 2025, marking the highest December shortfall on record despite Trump administration claims of fiscal success through tariff revenues.

Story Highlights

- December 2025 deficit hit $144.75 billion, up 67% from $86.73 billion in December 2024

- First quarter of fiscal year 2026 accumulated $602.38 billion in deficits

- Tariff revenues slowed to their smallest gains since July despite $264 billion collected in 2025

- Corporate tax receipts plummeted 28% while income tax collections rose 6.6%

- Calendar year 2025 deficit improved to $1.67 trillion from $2.0 trillion in 2024

Record December Deficit Signals Fiscal Strain

The Treasury Department’s January 13 release revealed December’s $144.75 billion deficit shattered previous December records, driven by higher government outlays that overwhelmed increased tax receipts. Total government receipts reached $484.4 billion, marking a 6.6% year-over-year increase, but spending pressures pushed the monthly shortfall significantly higher than the previous year’s $86.73 billion December deficit.

This December figure brought the cumulative deficit for fiscal year 2026’s first quarter to $602.38 billion, closely matching Congressional Budget Office estimates of $601 billion. The substantial quarterly shortfall puts the government on track for continued elevated deficit levels despite Trump administration claims of fiscal improvement through trade policy.

Tariff Revenue Momentum Stalls While Corporate Taxes Collapse

Customs duties generated approximately $28 billion in December, representing the smallest monthly tariff collection since July 2025. This slowdown occurred despite the administration’s aggressive tariff policies that produced record $264 billion in total customs revenue for calendar year 2025, up $185 billion from the previous year. The deceleration raises questions about the sustainability of tariff-driven revenue growth.

Corporate tax receipts experienced a dramatic 28% decline in December, offsetting gains from individual income taxes and social insurance contributions. This corporate tax collapse reflects the impact of recent tax legislation, including H.R. 1 and related measures that reduced business tax obligations. The divergent revenue streams highlight the complex fiscal trade-offs embedded in current policy approaches.

Mixed Signals on Trump Administration Fiscal Performance

Treasury Secretary Scott Bessent praised the administration’s tariff strategy, pointing to the calendar year 2025 deficit improvement from $2.0 trillion to $1.67 trillion as evidence of policy success. However, analysts including those at JPMorgan have adjusted these figures upward to above $1.9 trillion when accounting for student loan accounting changes and other timing distortions that mask the true fiscal picture.

The Congressional Budget Office projects fiscal year 2026 will close with a $1.713 trillion deficit, while broader tax legislation could add $3.4 trillion to cumulative deficits through 2034. These projections underscore the long-term fiscal challenges facing the government despite short-term revenue improvements from trade policies that face potential Supreme Court challenges.

Deficit Trajectory Threatens Economic Stability

The deficit-to-GDP ratio remains above 6%, creating risks for inflation and debt service costs as mandatory spending programs continue expanding. Interest payments on existing debt compound the fiscal pressure, while the twelve-month rolling deficit sits at approximately $1.7 trillion according to the Committee for a Responsible Federal Budget.

Industry sectors dependent on imports face continued uncertainty as tariff policies drive revenue but create economic distortions. The combination of rising outlays, volatile revenue streams, and pending legal challenges to trade policies creates a precarious fiscal environment that demands careful monitoring and potential policy adjustments to ensure long-term economic stability.

Sources:

TTNews – Budget Deficit Shrinks 2025

Trading Economics – United States Government Budget Value

Bipartisan Policy Center – Deficit Tracker

MarketScreener – US December Treasury Budget Deficit

Committee for a Responsible Federal Budget – 12-Month Rolling Deficit

Joint Economic Committee – December Closes with $144.75 Billion Deficit

Fidelity Fixed Income – Treasury Budget News

Congressional Budget Office – Monthly Budget Review